In recent years businesses are increasingly transitioning from traditional WAN and MPLS network architectures to Software-Defined Wide Area Network (SD-WAN) solutions. This trend is primarily due to SD-WAN's ability to offer a significant improvement to network performance, scalability and security features, whilst also reducing operational overheads, with businesses of all scales often seeing significant Returns On Investment (ROI).

There are many key factors and technical considerations that you should consider when choosing an SD-WAN solution, with the weight that each factor bears being determined by your individual business operations, goals and network criteria. It’s important to select an SD-WAN solution that can integrate with your pre-existing legacy, proprietary and security systems. To assist with this process, in this article we've broken down each vendor's solutions and the depth of their capabilities.

Struggling to determine which features are important to your business? We've outlined how to compare SD-WAN solutions here. Alternatively, find out what each feature does with our glossary and learning centre. |

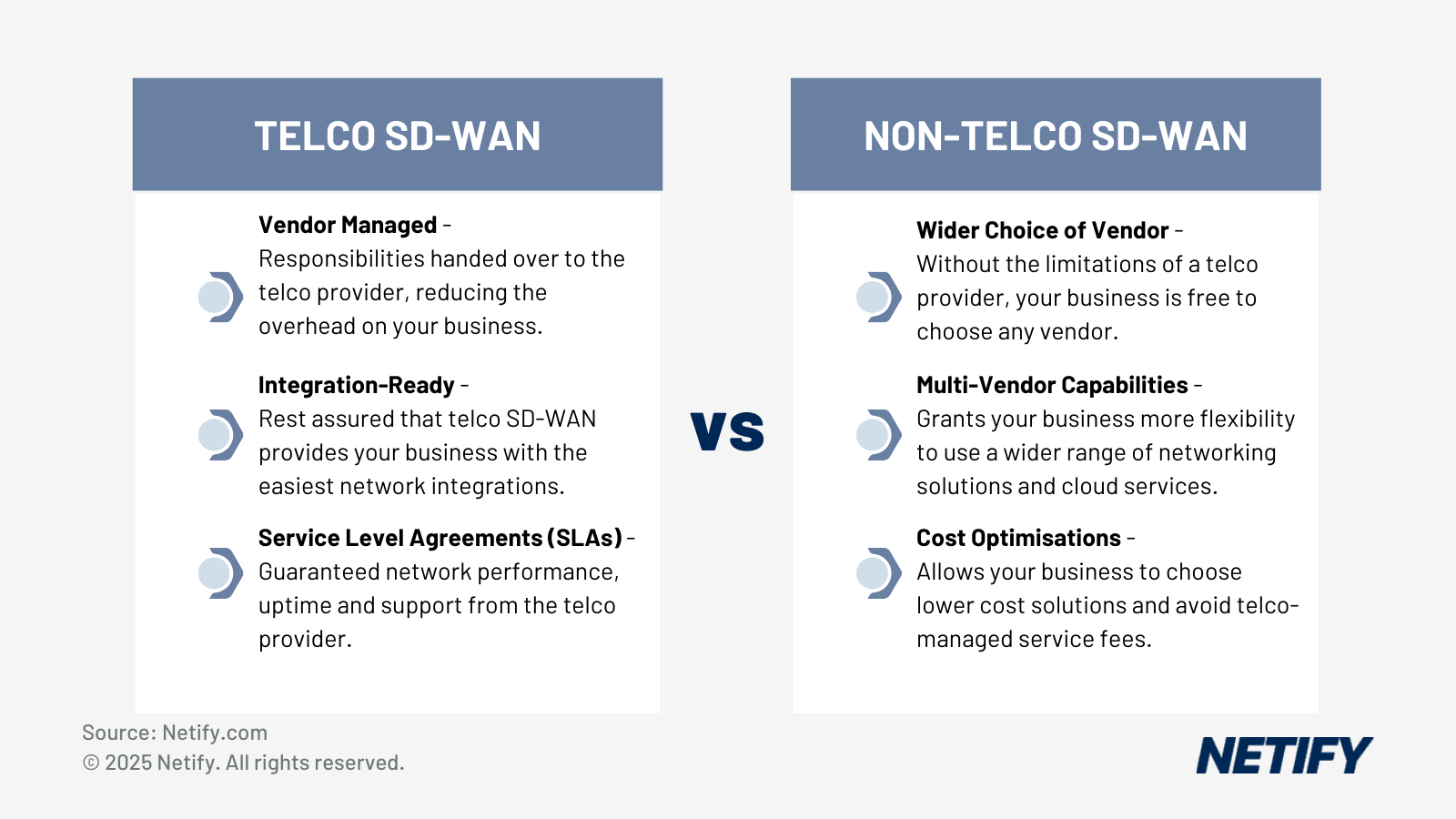

For those that don't have the internal expertise or dedicated resources to manage their network, one of the benefits of Telco providers that offer managed SD-WAN solutions is that the management responsibility is handed over to external experts. Integrating a new SD-WAN solution with existing infrastructure and IT systems can be complex and requires careful planning, therefore, through a managed model, you can rest assured that your business will be guided through the process.

| Vendor | SASE Network Security | Traffic QoS | Deployment | Managed Services | Reporting | Cost |

|---|---|---|---|---|---|---|

| Fortinet | Built-in Next-Generation Firewall (NGFW), Zero Trust Network Access (ZTNA), IPS and SSL inspection. | Offers a large range of QoS settings, actioned through dynamic prioritisation and traffic shaping. Also uses deep packet inspection (DPI), application-based policies and WAN optimisation to improve performance for SaaS, VoIP, and cloud applications. | On-premises, cloud-managed, and hybrid SD-WAN options. | Fortinet's secure SD-WAN is one of the most-used solutions by the Telco SD-WAN providers. | FortiAnalyzer provides AI-driven insights, historical trends and real-time visibility into network performance and security. | Reduces costs by leveraging low-cost broadband, consolidating networking and security functions and offering flexible licensing models. |

| Cisco | Offers built-in NGFW, IPS, DNS security, URL filtering, and Zero Trust Network Access (ZTNA). Integrates with Cisco Umbrella for cloud security and provides end-to-end encrypted traffic protection. | Implements QoS with dynamic prioritisation for applications. Ensures low latency for voice, video and cloud services using policy-based traffic management. | Supports on-premises, hybrid, and fully cloud-based SD-WAN deployments. | Includes professional and managed services for ongoing support. | vAnalytics provides AI-driven insights, historical performance trends and application-level visibility. | Reduces costs by leveraging broadband, consolidating security and networking functions, and offering flexible licensing models. Helps reduce reliance on expensive MPLS circuits. |

| Palo Alto Networks | Offers built-in Next-Generation Firewall (NGFW), Zero Trust Network Access (ZTNA) and threat protection, alongside deep packet inspection and segmentation. | Offers dynamic QoS settings, application-aware prioritisation and automated bandwidth allocation to maintain low latency for critical applications. Utilises policy-based routing and WAN optimisation to reduce latency and improve performance. | Available as a fully cloud-managed, hybrid, or on-premises solution. | N/A | AI-driven insights, real-time and historical analytics and visibility into application and network performance through the Prisma SD-WAN dashboard. | Reduces reliance on expensive MPLS circuits by leveraging broadband and cloud-based security. Consolidates networking and security functions to lower operational costs. |

| Versa Networks | Offers built-in Next-Generation Firewall (NGFW), Secure Web Gateway (SWG) and Zero Trust Network Access (ZTNA). | Provides granular QoS policies with dynamic traffic prioritisation and deep packet inspection (DPI) along with WAN optimisation to help reduce latency. | Supports on-premises, hybrid, and fully cloud-based SD-WAN deployments. | N/A | AI-driven analytics provide historical insights, real-time monitoring and application-level visibility to optimise network performance. | Reduces reliance on MPLS by leveraging broadband and LTE/5G. Integrated security eliminates the need for separate security systems, lowering costs. |

| HPE (Aruba EdgeConnect) | Includes built-in NGFW, IDS/IPS and cloud-based security integrations via Aruba ESP and SASE partnerships. Zero Trust capabilities ensure end-to-end security, with multiple VPNs on a single WAN for improved segmentation. | Offers QoS with dynamic traffic prioritisation and automated bandwidth allocation. Improves application performance through techniques like first-packet iQ, WAN optimisation, TCP acceleration and DPI. | Supports on-premises, hybrid and fully cloud-based SD-WAN. | N/A | Provides AI-driven insights, real-time monitoring and application-level visibility through Aruba Orchestrator. | Reduces costs by leveraging broadband connectivity, consolidating network functions and offering flexible licensing models. |

| Huawei | Integrates security features such as Next-Generation Firewall (NGFW) and supports end-to-end IPsec encryption. | Offers advanced QoS settings, including hierarchical QoS (HQoS) and intelligent traffic steering, ensuring optimal performance for key applications. | Offers on-premises, hybrid and fully cloud-based deployment options. | N/A | Provides detailed analytics and reporting capabilities, offering AI-driven insights and application-level visibility. | Reduces reliance on expensive MPLS circuits by leveraging cost-effective broadband and consolidating network functions, lowering operational expenses. |

| Juniper Networks | Built-in NGFW, Zero Trust security and threat intelligence via Security Director Cloud, supporting multiple VPNs on one WAN link for improved segmentation and security. | AI-driven dynamic QoS, with DPI and policy-based routing prioritising important applications and automatically adjusting bandwidth based on conditions. | Supports on-premises, hybrid, and cloud-based SD-WAN deployments. | N/A | Offers AI-driven insights, historical trend analysis and detailed application visibility via Mist AI and Marvis Virtual Network Assistant. | Reduces MPLS dependency by leveraging broadband, with AI-driven optimisation lowering operational expenses. |

| Ericsson (Cradlepoint) | Features built-in NGFW, Zero Trust Network Access (ZTNA) and threat intelligence integrations, with support for multiple VPNs per WAN for improved segmentation. | Offers QoS settings with dynamic traffic prioritisation, WAN optimisation, DPI and AI-driven policies for cloud-based and latency-sensitive applications. | Available as on-premises, hybrid and cloud-native deployments. | N/A | AI-driven analytics provide deep insights into network performance and bandwidth usage, enabling predictive maintenance. | Reduces costs by leveraging broadband, consolidating network functions and offering flexible licensing models. |

| Peplink | Offers built-in NGFW, intrusion prevention and content filtering. Supports ZTNA and integrates with third-party security platforms, while also supporting multiple VPNs over a single WAN connection. | Provides application-based QoS with dynamic bandwidth control, WAN smoothing and DPI for key application performance. | Offers on-premises, cloud-based and hybrid SD-WAN deployments. | N/A | InControl 2 provides real-time analytics, historical trend reports and AI-driven insights for proactive network management. | Reduces reliance on expensive MPLS by leveraging low-cost broadband and cellular connectivity, while SpeedFusion optimises bandwidth usage. |

| Barracuda Networks | Provides security features such as NGFW capabilities, ZTNA and compliance tools. | Barracuda offers limited QoS settings, including dynamic adjustments and protocol prioritisation, achieved with WAN optimisation, DPI and application-specific policies to reduce latency and increase throughput. | Barracuda offers on-premises, hybrid and fully cloud-based SD-WAN options. | N/A | Barracuda provides analytics tools and reporting capabilities, offering AI-driven insights, historical trends and detailed application-level visibility. | Leverages low-cost broadband connections and consolidates network functions, reducing reliance on expensive MPLS circuits. |

| Aryaka | Includes built-in security such as an NGFW, Secure Web Gateway (SWG) and ZTNA, while also supporting multiple VPNs per WAN connection for data segregation. | Provides QoS with dynamic bandwidth allocation and prioritisation, with WAN optimisation, application acceleration and DPI. | Available as fully managed cloud-based SD-WAN, hybrid or on-premises solutions. | Delivers SD-WAN as a service over a private network, eliminating the need for customers to build their own solutions. | Offers AI-driven network insights, historical performance data and detailed application-level visibility. | Reduces reliance on MPLS by leveraging low-cost broadband, while Aryaka’s private backbone ensures performance. Provides predictable costs. |

| Cato Networks | Built-in security includes NGFW, SWG, ZTNA and Advanced Threat Protection (ATP), fully converged into the SD-WAN fabric with support for multiple VPNs on a single WAN. | Uses a range of QoS techniques, such as dynamic bandwidth allocation, application-aware routing, WAN optimisation and DPI, benefiting cloud and SaaS applications. | Offers cloud-native, hybrid and on-premises deployment models. | Converges SD-WAN and security into a global, cloud-native platform as a single-vendor SASE solution. | Provides AI-driven analytics with real-time network insights, historical trend analysis and detailed application-level visibility. | Reduces reliance on expensive MPLS by leveraging low-cost broadband and consolidating security and networking functions into a single platform. |

| Ecessa | Integrates basic firewall capabilities and supports third-party security tools. While not NGFW-native, it complements existing security frameworks and can be used alongside other solutions to meet compliance needs. | Offers configurable QoS settings to prioritise applications via DPI and policy-based routing, steering traffic by application type. | Supports on-premises and hybrid models. | N/A | EdgeView includes performance monitoring, historical trend analysis and real-time alerts. | Reduces costs by leveraging broadband and eliminating MPLS dependency. |

| Adaptiv Networks | Built-in firewall and secure VPN tunnels. Adaptiv doesn’t offer a full NGFW, but integrates with third-party security tools and follows security best practices. Supports multiple VPNs on a single WAN for segmentation. | Enables traffic prioritisation for critical applications, with dynamic QoS adjustments based on real-time conditions to maintain performance. Supports traffic shaping and DPI. | Available as cloud-managed or hybrid deployment. | N/A | Provides a cloud-based analytics dashboard with real-time and historical data, enabling bandwidth planning and traffic optimisation. | Leverages low-cost broadband and eliminates the need for costly MPLS in many cases. Simple licensing reduces budgeting complexity. |

| Extreme Networks | Built-in security includes stateful firewalling, IDS/IPS, and integration with third-party security platforms. Offers Zero Trust support and centralised policy enforcement, with multiple VPNs for multi-tenant use cases. | Offers granular QoS settings, WAN optimisation, DPI and application-specific traffic shaping to prioritise business-critical applications. | Available on-premises, cloud-based or hybrid deployments. | N/A | Provides detailed application-level analytics and network health reports. AI-powered insights help identify issues proactively and optimise performance. | Reduces dependency on MPLS through broadband-first designs and by consolidating network functions. |

| FatPipe Networks | Includes a built-in firewall and supports integration with third-party security tools. Not a full NGFW, but offers encryption, DDoS protection and compliance support for regulated industries, and supports multiple encrypted tunnels. | Offers granular QoS controls with real-time adjustments, using DPI, compression, WAN optimisation and packet duplication. | Available in on-premises, hybrid and cloud-hosted deployments. | N/A | Includes performance dashboards and historical analytics for bandwidth, traffic patterns and application usage. | Reduces MPLS dependency by using broadband links while maintaining performance and uptime. Consolidates multiple functions to reduce CAPEX and OPEX. |

| Forcepoint | SD-WAN is integrated with Forcepoint’s NGFW and built-in threat protection, including IPS, SSL inspection, and ZTNA. Multiple VPNs can run over a single WAN for improved segmentation. | Offers granular QoS controls to prioritise latency-sensitive applications via DPI and custom application policies. | Available as physical, virtual, cloud-hosted or hybrid deployments. | N/A | Built-in analytics provide application-level visibility, usage trends and real-time alerts. | Reduces costs by utilising cheaper broadband links over MPLS, consolidating firewall and SD-WAN functions, and offering simplified licensing. |

| Mushroom Networks | Includes firewall capabilities and integrates with third-party security platforms. Supports multiple VPNs per WAN link to segment traffic securely. | Offers traffic shaping, flow control, error correction and adaptive routing for prioritising essential applications. | Available as on-premises, hybrid or fully cloud-managed. | Enables channel partners and service providers to build custom SD-WANs via its autopilot service, offering application-centric overlay tunnels and VNFs. | Provides real-time and historical traffic analytics. Detailed reports include application usage, link health and bandwidth consumption. | Reduces dependency on MPLS by leveraging multiple lower-cost broadband links. Consolidated functions lower total infrastructure costs. |

| Nokia (Nuage Networks) | Includes built-in stateful firewall, micro-segmentation, and integration with third-party security solutions. Supports Zero Trust models with role-based access and policy enforcement, plus multiple VPNs per WAN link. | Enables granular QoS settings with dynamic adjustments based on application and network conditions. Uses DPI and application-aware policies to improve performance. | Supports on-premises, hybrid and fully cloud-hosted SD-WAN deployments. | With 70 certified managed service providers and 700+ enterprise customers, Nuage Networks have a long history of providing managed SD-WAN services for varied business requirements. | Provides detailed analytics through the VNS portal, including real-time and historical views, application visibility and link utilisation metrics. | Reduces costs by enabling the use of lower-cost broadband and consolidating multiple network functions. |

| Oracle | Integrates with third-party security platforms but does not include native NGFW or ZTNA, instead focusing on segmentation, encryption and traffic isolation. | Offers granular QoS settings, with DPI and application-specific policies to optimise traffic routing. | Supports on-premises, cloud-hosted and hybrid deployment models. | Ideal for enterprises already using Oracle Cloud, providing real-time application support across dispersed sites and multiple WAN links. | Provides in-depth analytics, including real-time and historical performance metrics. | Customers benefit from fewer hardware requirements and reduced transport costs by replacing costly MPLS with cheaper broadband links. |

| Riverbed Technology | Includes a built-in firewall, segmentation, and integration with third-party security tools. | Leverages WAN optimisation, DPI and application-aware policies to enable granular QoS controls prioritising latency-sensitive traffic. | Supports on-premises, hybrid and cloud-based deployments. | Transitioned from WAN optimisation (Steelhead) to SD-WAN (SteelConnect), leveraging a global backbone and application acceleration to serve large enterprises. | Built-in analytics offer traffic visibility, usage trends and application insights. | Enables use of lower-cost broadband links and reduces dependency on MPLS. Consolidated management tools lower operational expenses. |

| SonicWall | SonicWall offers built-in integrations of their NGFW, threat prevention and Zero Trust features, with support for multiple VPNs per WAN interface. | Offers granular QoS controls and application-layer intelligence to optimise throughput and reduce latency, prioritising essential application traffic. | Available in on-premises, cloud-managed and hybrid models. | Integrates SD-WAN into firewall appliances, targeting SMBs via TZ series devices and the Capture Cloud Platform for unified security and networking. | NSM provides detailed traffic analytics, application-level visibility and historical reporting. | Reduces dependency on MPLS by leveraging broadband and LTE links. Consolidates security and networking in one appliance, lowering total cost of ownership (TCO). |

| Sophos | Includes integrated NGFW, IPS, anti-malware and ZTNA, while supporting multiple VPNs over a single WAN link. | Offers application-aware traffic shaping, DPI and policy-based routing to optimise performance for SaaS and cloud applications. | Available as cloud-managed, hybrid or on-premises solutions. | Designed for SMB and mid-market customers prioritising security, with gradually implemented SASE services via partnerships (e.g. Zscaler for SSE). | Offers real-time analytics, application-level visibility, and historical reporting via Sophos Central. | Leverages low-cost broadband links and eliminates the need for multiple point solutions by combining SD-WAN with embedded security, reducing total cost of ownership. |

| Turnium | Includes an integrated firewall, traffic segmentation and secure tunnelling. Not positioned as a full security stack, but allows integration with third-party security solutions and supports multiple encrypted tunnels per WAN link. | Enables traffic shaping, packet-based link aggregation and loss recovery to ensure QoS. | Available as on-premises, virtual and cloud-hosted solutions. | Turnium provides the networking element while partners handle security, management, orchestration and other managed services. | Provides real-time traffic monitoring and usage reports, with visibility into application behavior, link performance and historical trends. | Reduces costs by using low-cost broadband and virtualising WAN functions. |

| VMware VeloCloud | Integrates with VMware SASE for NGFW, ZTNA and secure web gateway, delivered via the cloud to reduce local complexity. Supports multiple VPNs per WAN for improved segmentation and resilience. | Offers application-aware QoS, with DPI, app-specific policies and real-time prioritisation for granular control across branches and cloud services. | Supports on-premises, hybrid and cloud-based models. | Operates a global network of 3,700+ gateways across 200+ PoPs, enabling a cloud-native architecture that also supports integration of third-party security services and multi-cloud connectivity. | Built-in analytics offer real-time and historical visibility, application-level insights and bandwidth usage metrics. | Reduces reliance on MPLS by prioritising cheaper broadband connectivity. |

| WatchGuard Technologies | Includes a built-in NGFW, intrusion prevention, web filtering and antivirus. Supports multiple VPNs over a single WAN for improved segmentation. | Offers configurable QoS settings to prioritise critical applications, with rules by application, port or protocol. Utilises traffic shaping and application-layer visibility via DPI. | Supports on-premises and hybrid models (cloud-based control available, though full cloud-native SD-WAN deployment is limited). | Embedded SD-WAN in Firebox appliances combines security and SD-WAN in one platform, providing cost advantages for SMBs. Additional security features can be added via the Total Security Suite. | WatchGuard Cloud includes reporting tools with application-level insights and bandwidth usage metrics. | Enables cost savings by reducing reliance on MPLS and combining network and security functions into a single appliance, using broadband as primary transport. |

| Zyxel | Integrated with Zyxel’s Unified Security Gateway, including firewall, content filtering, and intrusion detection. Supports multiple IPsec VPNs on a single WAN interface for security and segmentation. | QoS policies centrally defined through Nebula and enforced via DPI. | Offers on-premises, hybrid and cloud-managed models. | Targets SMBs and MSPs, aiming to make SD-WAN accessible to all. Allows MSPs to deploy endpoints across client sites to create high-availability network clouds. | Nebula provides real-time and historical analytics on bandwidth usage, traffic patterns and application performance. | Prioritises use of broadband and LTE, reducing reliance on costly MPLS circuits. |

| Bigleaf Networks | N/A (Customers are expected to integrate their own firewalls or third-party security tools.) | Offers application-aware QoS that prioritises traffic automatically via failover, session re-routing and real-time link assessments. | Offers cloud-based models only. | Ideal for SMBs needing reliable internet for cloud apps without extensive IT resources. Operates an extensive backbone (11 PoPs) and peers with 150+ cloud, content, and carrier networks. | Provides live and historical reporting on circuit performance, application behavior and outage history. | Enables use of affordable broadband links instead of MPLS. |

| Check Point | Integrates a full NGFW, IPS, antivirus, anti-bot, URL filtering and Zero Trust controls. | Provides granular QoS with dynamic bandwidth allocation, application-layer awareness, DPI and traffic shaping. | Supports on-premises, hybrid or cloud-delivered SD-WAN. | Released Quantum SD-WAN in 2023 as a ground-up solution to tightly integrate with Check Point’s security. Positioned as part of a complete SASE offering when combined with Harmony Connect (SSE). | Provides real-time and historical analytics through the Infinity Portal. | Consolidates network and security into one platform and enables use of affordable broadband while reducing MPLS dependency. |

| Cloudflare | Provides built-in Zero Trust security with secure web gateway, next-gen firewall and zero trust network architecture. | Offers configurable QoS policies, enabling prioritisation of latency-sensitive apps via DPI and traffic shaping. | Fully cloud-delivered model, with hybrid support via existing infrastructure. | Offers Magic WAN, a cloud-based SD-WAN alternative built on Cloudflare’s global edge network, minimising on-prem hardware by using its private backbone. Part of the Cloudflare One SASE platform. | Offers real-time and historical analytics with application-level insights. | Replaces MPLS with cost-effective broadband by leveraging Cloudflare’s global network. |

| FlexiWAN | Offers integrated firewall capabilities and supports third-party security services. Users can choose their preferred security stack, aligning with flexiWAN’s modular open-source design. | Allows application-based prioritisation and dynamic traffic shaping. Provides performance monitoring for specific applications. | Supports cloud-managed, hybrid and on-premises deployments. | The industry’s first open-source SD-WAN solution, removing vendor lock-in and enabling dynamic third-party applications and SASE integrations. Offers a hardware-agnostic, cost-effective model that scales from small devices to cloud platforms. | Offers real-time dashboards and historical data on bandwidth, application usage and network health. | Reduces costs by using low-cost internet and consolidating network functions. Open-source licensing avoids vendor lock-in and allows budget-friendly scaling. |

| Netskope | Netskope’s SD-WAN includes embedded NGFW, Secure Web Gateway (SWG), Cloud Access Security Broker (CASB), ZTNA and supports multiple VPN overlays per WAN link for improved segmentation. | Provides dynamic adjustments via DPI and application-based policies to deliver QoS. | Supports cloud-native, hybrid and on-premises deployments. | Introduced as part of Netskope’s Borderless SD-WAN after acquiring Infiot in 2022. Delivered via the NewEdge network (71+ regions) as a single-vendor SASE solution that bridges networking and security without trade-offs. | Offers analytics with AI-powered insights, historical trend data and detailed traffic reports. | Reduces reliance on MPLS by using broadband and cellular links. |

| Zscaler | Fully integrates ZTNA, cloud firewall and advanced threat protection, with support for multiple VPNs over a single WAN. | Enables granular QoS with dynamic adjustment based on real-time application requirements, using application-aware routing and cloud proximity for SaaS and web performance. | Cloud-delivered by design, with hybrid support via integration with on-premises infrastructure and SD-WAN partners. | Transitioned from a security partner model to a full SASE offering, now leading the SASE market with a 20% revenue share. Zscaler’s Zero Trust Branch Connectivity appliance (introduced 2023) integrates SD-WAN functionality into its cloud platform. | Includes AI-driven analytics for real-time insights and historical trends. | Utilises broadband and mobile links (LTE/5G) to reduce MPLS dependency. |

| AT&T | AT&T's SD-WAN solutions incorporate security features such as NGFWs, SASE frameworks, and ZTNA. | Offers SLAs for network availability, packet loss, congestion, jitter and latency. | On-premises, hybrid and fully cloud-based SD-WAN options. | Offers a range of managed SD-WAN services, partnering with multiple vendors (Cisco Catalyst, VMware VeloCloud, HPE Aruba EdgeConnect, FatPipe, etc.). Provides fully managed and co-managed options, as well as a self-service SD-WAN for SMBs. | N/A | Optimises transport and operational costs by reducing MPLS reliance, with centralised management, zero-touch deployment and improved application performance. |

| BT | BT's SD-WAN solutions incorporate advanced security measures such as NGFW, ZTNA, SWG and CASB. | BT offers a 100% target availability SLA on its BTnet Leased Line service, with compensation if unmet. | On-premises, hybrid and fully cloud-based SD-WAN options. | BT partners with Cisco Catalyst, Cisco Meraki, Nuage Networks, Palo Alto Prisma, Fortinet, and VMware VeloCloud for its managed SD-WAN services. It has launched global managed offerings (e.g. with Cisco for performance-focused solutions and Fortinet for security-centric SD-WAN). | N/A | Optimises transport and operational costs through reduced MPLS reliance, centralised management, zero-touch deployment and improved application performance. |

| Lumen (CenturyLink) | Lumen's SD-WAN solutions incorporate advanced security measures such as stateful firewalls, IDS/IPS, URL filtering and content filtering. | Offers SLAs for frame delivery, frame delay, and delay variation (99.999% availability with specified loss and jitter thresholds). | On-premises, hybrid and fully cloud-based options. | Delivers fully managed SD-WAN solutions, partnering with Versa, VMware VeloCloud, Cisco Meraki, Cisco Catalyst and Fortinet. Also offers co-managed solutions with improved network visibility and control. Notably, Lumen provides a Sovereign Secure SASE solution with Versa for highly regulated industries. | N/A | Optimises transport and operational costs by reducing MPLS reliance, centralised management, zero-touch deployment and improved application performance. |

| China Mobile (CMI) | China Mobile's SD-WAN solutions offer traffic encryption. | Provides a 99.95% availability SLA (CGW to CGW), with latency guarantees available on request. | On-premises, hybrid and fully cloud-based SD-WAN solutions. | Delivers SD-WAN services via its subsidiary CMI for cross-border connectivity. Integrates with a global backbone for improved performance and connectivity, and offers bilingual support and direct China-to-international connectivity beneficial for businesses operating in China. | N/A | By utilising broadband, internet and LTE, China Mobile's SD-WAN reduces reliance on traditional MPLS circuits, yielding cost efficiencies. |

| China Telecom | Offers security integrations such as NGFW, UTM, IDS, and IPS. | Provides SLAs including uptime guarantees and latency thresholds. | On-premises, hybrid, and fully cloud-based SD-WAN options. | Provides managed and self-managed SD-WAN solutions through a partnership with Versa Networks. Its platform is designed to comply with Chinese regulations while integrating mainstream SaaS applications, enabling secure, cross-border connectivity. | N/A | Leverages cost-effective broadband and consolidates network functions, reducing reliance on MPLS circuits and lowering operational expenses. |

| China Unicom | China Unicom's SD-WAN solutions offer end-to-end encrypted IPsec VPN tunnels. | N/A | On-premises, hybrid, and fully cloud-based SD-WAN solutions. | Delivers managed SD-WAN focused on cross-border networking and hybrid cloud integration. Tailored for enterprises needing high-performance links between China and other regions, leveraging partnerships with Cisco, Huawei and ngena. | N/A | By using a mix of MPLS, VPN and LTE, China Unicom's SD-WAN enables more efficient bandwidth use, reducing MPLS reliance. |

| Comcast Business | Comcast Business' SD-WAN solutions integrate security features such as NGFW, SWG and UTM. | Offers a 99.99% network uptime SLA via its extensive IP backbone. | On-premises, hybrid, and fully cloud-based SD-WAN options. | Offers fully managed SD-WAN through partnerships with Versa Networks, Fortinet, HPE Aruba EdgeConnect, Cisco Catalyst and Cisco Meraki. Its cloud-based ActiveCore platform provides unified management and automation capabilities for these solutions. | N/A | Leverages cost-effective broadband options, reducing reliance on expensive MPLS circuits. |

| Deutsche Telekom | Deutsche Telekom offers integrations for SASE frameworks, including SWG and CASB. | Provides service and performance SLAs. | On-premises, hybrid and fully cloud-based SD-WAN options. | Offers managed SD-WAN under the Telekom SD-X platform, which acts as a marketplace for modular, multivendor service components. Customers can select and combine networking and security services (internet, security, WiFi, VPN, etc.) in a unified solution. | N/A | By leveraging low-cost broadband and flexible licensing models, Deutsche Telekom’s SD-WAN reduces MPLS reliance and operational expenses. |

| GTT Communications | GTT's SD-WAN integrates security measures such as unified firewall capabilities. | Provides 99.999% availability SLAs with ≤0.1% packet loss and ≤2ms jitter. | On-premises, hybrid and fully cloud-based SD-WAN solutions. | Partners with Fortinet, HPE Aruba EdgeConnect and VMware VeloCloud for managed SD-WAN services. With a global backbone of 450+ PoPs, GTT delivers secure, scalable and cloud-ready solutions tailored for distributed enterprises. | N/A | GTT's SD-WAN uses broadband, wireless and MPLS in combination to optimise connectivity and scalability, reducing reliance on MPLS circuits. |

| Hughes Network Systems | Security offerings include NGFW, SWG and encryption capabilities. | No formal SLAs, but uses ActivePath technology (Intelligent Multipath Replication) to replicate traffic across paths and prevent brownouts/blackouts. | On-premises, hybrid and cloud-based architectures. | Introduced HughesON Managed SD-WAN in 2017, complementing its portfolio of managed services for multi-site organizations. Hughes manages thousands of SD-WAN endpoints worldwide and has won industry awards (e.g., SD-WAN Product of the Year 2018) for its capabilities. | N/A | Supports both broadband and LTE to reduce MPLS dependency. |

| KDDI | Offers KDDI Security Cloud based on Symantec Blue Coat, including NGFW, SWG, advanced threat prevention and managed threat detection/response. | Provides SLAs guaranteeing availability, performance, and support response times. | On-premises, hybrid and fully cloud-based SD-WAN. | KDDI deploys managed SD-WAN globally, partnering with vendors like Cisco Catalyst, Aruba EdgeConnect and Fortinet. It has notable customers such as All Nippon Airways, where KDDI’s SD-WAN enabled new work styles with consistent service quality across global sites. | N/A | Reduces WAN costs by using less expensive broadband instead of costly MPLS circuits. |

| Macquarie Technology Group | Dynamic key encryption at the packet level ensures end-to-end data security across all links. | Provides >99.9% uptime guarantee (with SLA) for its network. | On-premises, hybrid and cloud-based SD-WAN solutions. | Serves over 6,000 SD-WAN sites in Australia, having selected VMware VeloCloud after evaluating 28 providers globally. Macquarie has won the VMware Partner Innovation Award for SD-WAN in APAC and is recognized as the Best SD-WAN Supplier in the region. | N/A | Utilises multiple links (including low-cost broadband and 4G) to create faster, more reliable connections, reducing MPLS reliance and cutting operational expenses. |

| TPx Communications | Integrated security measures include VPN encryption and NGFW capabilities. | Offers SLAs with a 100% uptime guarantee for UCaaS when paired with their SD-WAN. | On-premises, hybrid and fully cloud-based SD-WAN solutions. | A leading US managed services provider with 50,000 customers and over 15,000 SD-WAN edges under management. An early adopter of VMware SD-WAN (since 2015), TPx has deep expertise in policy design and features on Vertical Systems Group’s U.S. Carrier Managed SD-WAN Leaderboard. | N/A | Leverages economical bandwidth options and eliminates the need for expensive MPLS circuits. |

| MetTel | MetTel's SD-WAN integrates its own stateful, context-aware NGFWs and segmentation capabilities for site-to-site communications without leaving the MetTel network. | Offers sub-second blackout and brownout protection, though no formal SD-WAN SLAs. | On-premises, hybrid and fully cloud-based SD-WAN solutions. | Delivers SD-WAN as a fully managed service across North America using its own cloud network (20 data centers/PoPs). MetTel maintains relationships with ~120 carriers and is an authorized Starlink reseller, extending its managed network services globally. | N/A | By combining existing and available circuits (DSL, LTE, 4G), MetTel’s SD-WAN reduces reliance on expensive MPLS circuits. |

| NTT Communications | NTT offers Secure Web Gateways at 75+ Local Cloud Centers worldwide, providing URL filtering, firewall protection, intrusion prevention and malware detection reporting. | Guarantees bandwidth (via SLA) and 99.999% network access (using MPLS-TP), plus SLAs for provisioning, recovery and notifications. | On-premises, hybrid and fully cloud-based SD-WAN solutions. | A global telecom provider recognized for launching the world’s first SD-WAN platform (coverage in 190+ countries). NTT operates a 100% software-defined network and maintains 75+ local cloud centers worldwide to optimize network, mobility and security services. | N/A | By supporting a mix of connectivity options (broadband, wireless, 4G/LTE), NTT’s SD-WAN allows businesses to reduce reliance on expensive MPLS circuits. |

| Orange Business Services | Orange's managed SD-WAN solutions offer NGFW, secure web gateways and encrypted VPN tunnels. | Provides clear SLAs guaranteeing performance and connectivity (e.g. site availability, device availability, time to repair). | On-premises, hybrid, and fully cloud-based SD-WAN options. | Leverages the world’s largest voice and data network (Orange Group), with 70+ cloud data centers and 50+ technology partnerships. Offers AI-driven networking and unified SD-WAN/SD-LAN solutions reinforced by 4G/5G connectivity. Recently launched SD-WAN Essentials, a co-managed service providing businesses greater control, reliability, performance, application-level routing and security features. | N/A | Utilises cost-effective connectivity options (broadband, LTE), reducing reliance on expensive MPLS circuits. |

| Singtel | Singtel's SD-WAN solutions incorporate integrated firewalls, antivirus, IPS, web filtering, and data encryption. | Provides SLA-guaranteed network performance over its business-grade network. | On-premises, hybrid and cloud-based SD-WAN solutions. | Asia’s leading communications technology group with a significant presence in Asia, Australia and Africa (serving 760M mobile users in 21 countries). Provides end-to-end network deployment services backed by 24/7 technical support and SLA-guaranteed performance. | N/A | By leveraging hybrid networking (MPLS + Internet), Singtel’s SD-WAN optimises bandwidth usage and reduces reliance on expensive circuits. |

| Spectrum Enterprise | Offers security measures such as firewalls, UTM, URL content filtering and intrusion prevention. | 100% network uptime SLA, with 24/7 US-based support and SLAs for uptime, latency and packet delivery. | Internet-based SD-WAN and hybrid configurations that integrate with existing Ethernet services. | Launched nationwide managed SD-WAN in 2019, integrated into its fiber network across the US. By utilising its fiber network, Spectrum provides highly available, scalable and geo-redundant connectivity, delivering high-performance, low-latency WAN solutions from any client location. | N/A | Leverages various connectivity options (broadband, LTE, etc.), allowing businesses to optimise costs by choosing the most appropriate transports. The managed model also reduces need for significant in-house resources. |

| Sprint | Sprint's SD-WAN integrates security measures including NGFW and UTM. | Offers SLAs for network node-to-node, end-to-end, and managed services (issues resolved within 24 hours). | On-premises, cloud-based and hybrid models. | First introduced SD-WAN to the Pacific region. Now covers 100+ countries, offering three tiers: SD-WAN Complete (fully managed end-to-end), SD-WAN Complete with Co-Management (shared control), and SD-WAN Service (network optimisation without full management), utilising Cisco Meraki, Versa Networks and VMware VeloCloud. | N/A | By using a mix of MPLS and broadband, Sprint’s SD-WAN optimises bandwidth usage and can lower operational expenses. |

| Tata Communications | Tata's managed SD-WAN incorporates advanced security measures such as NGFW, secure web gateways, and micro-segmentation. | Offers end-to-end SLA guarantees for the WAN and uptime guarantees as part of its SLA framework. | On-premises, hybrid and fully cloud-based options. | A leading Indian telecom company providing global network services. Has implemented SD-WAN at 5,000+ sites in 120+ countries, managing over 3,000 customer sites worldwide. Recently launched a unified hosted SASE solution combining SD-WAN with SSE capabilities, and offers its own IZO SD-WAN managed solution covering 130+ countries. | N/A | Leverages existing internet connections to reduce reliance on expensive MPLS circuits. Also provides a fully managed service with a single SLA, simplifying management and potentially lowering operational costs. |

| Telefónica | Telefónica's SD-WAN solutions incorporate security measures such as NGFW, SASE and ZTNA. | Seamless integration with major cloud platforms, with private backbones for multi-cloud, plus global SLAs and traffic guarantees (e.g. via Telefónica Global Solutions network). | On-premises, hybrid, and fully cloud-based SD-WAN options. | Spanish multinational with SD-WAN offerings via partnerships (e.g. Nokia Nuage). Since 2017, uses Nuage’s VNS platform to deliver automated, end-to-end services with customer self-service portals. In 2024, integrated Nokia’s Network Exposure Function in Spain to leverage Network-as-Code and developed private 5G capabilities for enterprise use. | N/A | By leveraging low-cost broadband and consolidating network functions, Telefónica's SD-WAN solutions help reduce reliance on expensive MPLS circuits. |

| Telia | Telia's SD-WAN provides firewall for direct internet access from offices. | 24-hour service level for customer edge devices, ensuring predictable service levels. | Fully managed and co-managed SD-WAN services. | Allows enterprises to attach their SD-WAN overlay to Telia Carrier’s backbone network. For security, Telia leverages relationships with Fortinet and Check Point. Telia was highlighted on Vertical Systems Group’s SD-WAN Coverage Analysis leaderboard as a top Global Provider. | N/A | Enables flexible use of both private (DataNet) and internet connections at the same site. Critical traffic can use private links while less important traffic uses internet, optimising cost and performance. |

| Telstra | The solution integrates NGFW, ZTNA and advanced threat protection. | SLAs covering uptime and latency guarantees. | On-premises, hybrid, and cloud-based deployments. | Australia's largest telco (among the world’s top 20) that provides fully managed services including project management, design, provisioning and maintenance of network infrastructure, backed by performance and uptime SLAs. Its SD-WAN combines Australia-wide gateways with partnerships (Cisco Meraki, Cisco Catalyst, VMware VeloCloud) to meet diverse customer needs. | N/A | Reduces reliance on MPLS by leveraging broadband with optimised routing. Also offers simplified licensing and bundled managed services to lower operational costs. |

| Verizon | Verizon adds managed security services, including built-in NGFW, ZTNA, and SWG. Also offers managed threat detection and response services. | Performance SLAs with uptime guarantees and latency thresholds. | On-premises, hybrid, and cloud-based SD-WAN deployments. | Offers a wide range of managed SD-WAN solutions through partnerships with leading vendors (Cisco, VMware, Fortinet, Versa, etc.). Focuses on security, cloud connectivity and global enterprise networking, integrating SD-WAN with its private network services and incorporating Zero Trust frameworks and AI-powered analytics for proactive issue resolution. | N/A | Offers flexible pricing models (pay-as-you-go, subscription) and streamlines operations by integrating multiple network functions into one solution, reducing hardware dependencies. |

| Virgin Media Business | Virgin Media offers next-generation security features such as stateful and next-gen firewalls, DNS filtering, URL filtering and antivirus protection. | Service level agreements (SLAs) tailored to the company’s specific infrastructure and needs. | On-premises, hybrid and cloud-based models. | Provides managed SD-WAN services with a focus on high-speed broadband and resilient connectivity. Primarily partners with Versa Networks and Fortinet to deliver fully managed network services that cater either to secure cloud connectivity or strict security requirements. | N/A | Utilises a hybrid network approach, combining private and public networks to optimise connectivity and reduce reliance on expensive circuits. |

| Vodafone | Vodafone's SD-WAN incorporates security measures such as NGFW, ZTNA and SASE frameworks. | Performance SLAs including uptime guarantees and latency thresholds. | On-premises, hybrid and fully cloud-based SD-WAN options. | Delivers managed SD-WAN via partnerships with Cisco Meraki, VMware VeloCloud and Juniper Networks. Vodafone’s SD-WAN is tailored for enterprises needing global coverage and 5G-ready networking, backed by Vodafone’s extensive fibre and mobile infrastructure. | N/A | Leverages cost-effective broadband, consolidates network functions, and offers straightforward licensing models. This reduces reliance on MPLS and lowers operational expenses. |

| Windstream | Windstream's SD-WAN incorporates security measures such as NGFW, ZTNA and SASE frameworks. | Offers performance SLAs with uptime guarantees and latency thresholds. | Offers flexible deployment models, including on-premises, hybrid and fully cloud-based SD-WAN. | Offers managed SD-WAN through partnerships with VMware VeloCloud and Fortinet. Focuses on optimising bandwidth utilisation, improving network security and ensuring high availability for multi-site businesses. Windstream integrates SD-WAN with its Kinetic Business fiber network to provide a hybrid WAN strategy for secure, scalable, high-speed connectivity. | N/A | Consolidates network functions and leverages cost-effective broadband, reducing reliance on expensive MPLS circuits and cutting operational expenses. |

| Zayo Group | Zayo SD-WAN incorporates security measures such as NGFW, ZTNA and SASE frameworks. | Guarantees 99.99% network uptime for on-net fiber and waves, with 24x7 service assurance and real-time network monitoring via its NOC. | On-premises, hybrid, and fully cloud-based SD-WAN solutions. | Delivers managed SD-WAN services with a focus on fiber-optic infrastructure and cloud connectivity. The platform is built to provide secure, low-latency networking for businesses relying on hybrid and multi-cloud environments. Zayo’s SD-WAN integrates with its extensive metro and long-haul fiber networks, ensuring high-performance, resilient connectivity alongside real-time analytics and intelligent traffic management. | N/A | By leveraging low-cost broadband options and consolidating network functions, Zayo's SD-WAN helps reduce reliance on expensive MPLS circuits and lower operational expenses. |

SD-WAN Vendors

- Fortinet

- Cisco

- Palo Alto Networks

- Versa Networks

- HPE (Aruba EdgeConnect)

- Huawei

- Juniper Networks

- Ericsson (Cradlepoint)

- Peplink

- Barracuda Networks

- Aryaka

- Cato Networks

- Ecessa

- Adaptiv Networks

- Extreme Networks

- FatPipe Networks

- Forcepoint

- Mushroom Networks

- Nokia (Nuage Networks)

- Oracle

- Riverbed Technology

- SonicWall

- Sophos

- Turnium

- VMware VeloCloud

- WatchGuard Technologies

- Zyxel

- Bigleaf Networks

- Checkpoint

- Cloudflare

- FlexiWAN

- Netskope

- Zscaler

- AT&T

- BT

- Lumen (CenturyLink)

- China Mobile (CMI)

- China Telecom

- China Unicom

- Comcast Business

- Deutsche Telekom

- GTT Communications

- Hughes Network Systems

- KDDI

- Macquarie Technology Group

- TPx Communications

- MetTel

- NTT Communications

- Orange Business Services

- Singtel

- Spectrum Enterprise

- Sprint

- Tata Communications

- Telefónica

- Telia

- Telstra

- Verizon

- Virgin Media Business

- Vodafone

- Windstream

- Zayo Group

Fortinet

Market Leader North America Latin America Europe Middle East & Africa Asia-Pacific Security

Fortinet claims to be the first vendor to integrate security and network functionality into a single system. This is achieved through their Secure SD-WAN solution - fully integrated into the FortiGate platform.

Now deployed by over 31,000 customers globally, prior to their SD-WAN solution, Fortinet were primarily a cybersecurity company. Originally producing FortiGate as a physical firewall solution, FortiGate featured alongside early Fortinet solutions, such as endpoint security and intrusion detection systems. In 2016, Fortinet moved onto their Security Fabric architecture (to enable communication between multiple network security products) which was their previous most network-focused offering.

By integrating their SD-WAN solution into the FortiGate security platform, Fortinet SD-WAN has become the forefront of their broader portfolio, offering businesses with all-round network security capabilities and an ideal choice for enterprises with sensitive data, secure connectivity or requirements for in-depth security monitoring. This has led to Fortinet's secure SD-WAN being one of the most-used solutions by the Telco SD-WAN providers.

| Feature | Vendor/Provider Support |

|---|---|

| Centralised Cloud Management | Fortinet’s FortiManager provides centralised SD-WAN management with real-time visibility, unified policy control and automation. |

| Support for Multiple Connection Types | Supports broadband, LTE, MPLS and satellite. Uses application-aware routing with FortiOS and AI-driven analytics to optimise paths dynamically for performance and reliability. Multiple VPNs can run on a single WAN connection and WAN Path Controller ensures seamless performance. |

| Integrated Security Features | Built-in Next-Generation Firewall (NGFW), Zero Trust Network Access (ZTNA), IPS and SSL inspection. |

| Quality of Service (QoS) | Offers a large range of QoS settings, actioned through dynamic prioritisation and traffic shaping. Also uses deep packet inspection (DPI), application-based policies and WAN optimisation to improve performance for SaaS, VoIP, and cloud applications. |

| Scalability and Flexibility | Scales from SMBs to global enterprises. Cloud-based orchestration supports multi-site expansion and hybrid workforce connectivity. FortiManager offers Zero-touch provisioning (ZTP), automated deployments and centralised policy management and integrates legacy infrastructure. |

| Cloud and Multi-Cloud Integration | Direct cloud on-ramps to AWS, Azure, and Google Cloud. Supports private backbone routing for lower latency and improved cloud application performance. |

| Resilience and Failover Capabilities | Sub-second failover with multi-path redundancy and real-time link monitoring to ensure uninterrupted connectivity. |

| Cost Efficiency | Reduces costs by leveraging low-cost broadband, consolidating networking and security functions and offering flexible licensing models. |

| Analytics and Reporting | FortiAnalyzer provides AI-driven insights, historical trends and real-time visibility into network performance and security. |

| Programmatic APIs | Open APIs for automation, custom integrations and network management. |

| Support for Cellular Connectivity | 5G/LTE support with integrated SIM management for failover, redundancy, and remote site connectivity. |

| AI Integrations | Uses AI-powered automation and anomaly detection. |

| Deployment Models Supported | On-premises, cloud-managed, and hybrid SD-WAN options. |

| Compliance and Regulatory Certifications | ISO 27001, SOC 2, PCI DSS and HIPAA compliance for regulated industries. |

| Support and Training Options | Fortinet offers a wide variety of training, as well as their QuickStart SD-WAN consulting services to help customers accelerate the time-to-value of their SD-WAN network implementation. |

| Target-Market Customers | Targets Finance, Healthcare, Retail, Manufacturing, Education, Government, Technology, Transportation, Energy and Telecommunications. |

Cisco

Market Leader North America Latin America Europe Middle East & Africa Asia-Pacific Security

Cisco entered the market through Meraki SD-WAN, which it acquired in 2012. Prior to this, Cisco's primary offering was Cisco IWAN, which was an on-premises SD-WAN device based on ISR branch routing.

Finally, in 2017, Cisco expanded its offerings through the acquisition of Viptela, creating a portfolio that could cater to all business requirements through the easier-to-use Meraki and more-in depth Viptela - which is reflected by the large volumes of SD-WAN providers offering both Cisco Catalyst sd wan and Cisco Meraki, showcasing that they are clearly one of the best sd wan vendors.

Viptela was acquired by Cisco due to the Viptela SD-WAN solution being specifically designed with a separation of data, control and management planes, which complimented Cisco's Digital Network Architecture (DNA). Today, Cisco's main SD-WAN (now rebranded from Cisco Viptela to Cisco Catalyst) is recognised as one of the leading SD-WAN solutions in the market, whilst Meraki SD-WAN is widely used for more simplified use cases.

| Feature | Vendor/Provider Support |

|---|---|

| Centralised Cloud Management | Cisco SD-WAN is managed via vManage, a unified dashboard providing real-time visibility, policy control and automation. |

| Support for Multiple Connection Types | Supports MPLS, broadband, LTE and satellite with intelligent path selection using AI-driven analytics. Utilises application-aware routing to optimise traffic paths based on real-time performance metrics. Supports multiple VPNs on a single WAN connection. |

| Integrated Security Features | Offers built-in NGFW, IPS, DNS security, URL filtering, and Zero Trust Network Access (ZTNA). Integrates with Cisco Umbrella for cloud security and provides end-to-end encrypted traffic protection. |

| Quality of Service (QoS) | Implements QoS with dynamic prioritisation for applications. Ensures low latency for voice, video and cloud services using policy-based traffic management. |

| Scalability and Flexibility | Designed for large enterprises, scaling across thousands of sites. Supports hybrid workforces and cloud-based expansions, with zero-touch provisioning (ZTP) and policy-based automation. Integrates with existing networking infrastructure, including MPLS. |

| Cloud and Multi-Cloud Integration | Provides direct cloud connectivity with AWS, Azure, and Google Cloud through optimised cloud on-ramps. Uses Cisco Cloud OnRamp for SaaS to improve application performance. |

| Resilience and Failover Capabilities | Ensures sub-second failover with multi-path redundancy and advanced link health monitoring. Uses Cisco's SD-WAN fabric for seamless failover in case of outages. |

| Cost Efficiency | Reduces costs by leveraging broadband, consolidating security and networking functions, and offering flexible licensing models. Helps reduce reliance on expensive MPLS circuits. |

| Analytics and Reporting | vAnalytics provides AI-driven insights, historical performance trends and application-level visibility. |

| Programmatic APIs | Offers open APIs for automation, network programmability and integration with IT workflows. |

| Support for Cellular Connectivity | Supports LTE/5G connectivity for backup and primary WAN links. |

| AI Integrations | Uses AI-driven analytics for automated policy adjustments, traffic optimisation and predictive network issue detection. |

| Deployment Models Supported | Supports on-premises, hybrid, and fully cloud-based SD-WAN deployments. |

| Compliance and Regulatory Certifications | Holds certifications including ISO 27001, SOC 2 and PCI DSS. |

| Support and Training Options | Offers 24/7 global support, dedicated technical account managers and online training through Cisco Learning Network. Includes professional and managed services for ongoing support. |

| Target-Market Customers | Targets Finance, Healthcare, Retail, Manufacturing, Education, Government, Technology, Transportation, Energy and Telecommunications sectors. |

Palo Alto Networks

Leader North America Latin America Middle East & Africa Security

Palo Alto Networks have long been known for their cybersecurity capabilities, predominantly through their Next-Generation Firewall (NGFW) technology. Through PAN-OS, Palo Alto provided Layer 7 visibility and control over network traffic utilising their firewall appliances – making them well-placed to move into the SD-WAN market for more security-focused use cases.

Palo Alto Networks produced their SD-WAN solution in 2020, self-dubbing it the "Industry's First Next-Generation SD-WAN Solution" and formed part of Palo Alto Networks' CloudGenix SD-WAN offering.

In 2021, Palo Alto launched Prisma Access, a Secure Access Service Edge (SASE) solution to implement both security and networking capabilities, which includes Application-Aware Routing (AAR) and Zero Touch Provisioning into a single solution. This has proved to be successful for Palo Alto, who are currently one of only three vendors recognised as a Leader across all three SASE-related Magic Quadrant reports:

Security Service Edge (SSE),

Single-Vendor SASE,

SD-WAN

| Feature | Vendor/Provider Support |

|---|---|

| Centralised Cloud Management | Palo Alto’s Prisma SD-WAN offers centralised cloud-based management via the Prisma SD-WAN dashboard. Prisma provides real-time visibility, unified policy control and AI-driven insights to simplify operations and improve network performance. |

| Support for Multiple Connection Types | Supports broadband, LTE, MPLS and satellite connections. Uses AI-powered path selection and real-time performance monitoring to optimise traffic routing dynamically, with sub-second failover and traffic steering based on real-time network conditions. |

| Integrated Security Features | Offers built-in Next-Generation Firewall (NGFW), Zero Trust Network Access (ZTNA) and threat protection, alongside deep packet inspection and segmentation. |

| Quality of Service (QoS) | Offers dynamic QoS settings, application-aware prioritisation and automated bandwidth allocation to maintain low latency for critical applications. Utilises both policy-based routing and WAN optimisation to reduce latency and improve application performance. |

| Scalability and Flexibility | Scales from small branch offices to large global enterprises. Supports hybrid workforce needs with cloud-managed and on-premises deployment options. Offers zero-touch provisioning and automated deployments via Prisma SD-WAN, with integrations for existing infrastructure. |

| Cloud and Multi-Cloud Integration | Direct cloud connections to AWS, Azure, Google Cloud, and SaaS applications. Uses private backbone connectivity and intelligent traffic steering to enable multi-cloud performance. |

| Resilience and Failover Capabilities | Provides sub-second failover, multi-path redundancy and AI-driven link monitoring. |

| Cost Efficiency | Reduces reliance on expensive MPLS circuits by leveraging broadband and cloud-based security. Consolidates networking and security functions to lower operational costs. |

| Analytics and Reporting | AI-driven insights, real-time and historical analytics and visibility into application and network performance through Prisma SD-WAN’s analytics dashboard. |

| Programmatic APIs | Open APIs enable automation, integration with IT service management tools and custom policy configurations. |

| Support for Cellular Connectivity | Supports LTE and 5G for backup connectivity and primary WAN in remote locations. |

| AI Integrations | Uses AI-powered analytics for predictive network optimisation, self-healing capabilities and automated policy tuning. |

| Deployment Models Supported | Available as a fully cloud-managed, hybrid, or on-premises solution. |

| Compliance and Regulatory Certifications | Certified for ISO 27001, SOC 2, PCI DSS and HIPAA. |

| Support and Training Options | 24/7 customer support, dedicated account managers, online training resources and documentation for self-service learning. |

| Target-Market Customers | Targets customers from Finance, Healthcare, Retail, Manufacturing, Education, Government, Technology, Transportation, Energy and Telecommunications markets. |

Versa Networks

Leader North America Latin America Europe Middle East & Africa Asia-Pacific Multi-tenancy Multi-deployment

Headquartered in California, Versa Networks were founded in 2012 and were one of the startups that helped form the SD-WAN market. Initially started by two brothers, Kumar Mehta who had previously served as VP Engineering at Juniper Networks (2004-2012) and Apurva Mehta, CTO and Chief Architect at Juniper Networks' Mobility Business Unit, Versa came from a background of networking expertise.

By October 2019, Versa Networks had over 1,000 total customers and sold more than 200,000 software licenses.

Versa’s operating system (VOS) not only offers SD-WAN but has been extended to form a SASE solution, making Versa Networks currently one of only three vendors recognised as a Leader across all three SASE-related Magic Quadrant reports:

Security Service Edge (SSE),

Single-Vendor SASE,

SD-WAN

| Feature | Vendor/Provider Support |

|---|---|

| Centralised Cloud Management | Versa offers a unified management platform, Versa Titan, providing real-time visibility, centralised policy enforcement, and AI-driven insights. |

| Support for Multiple Connection Types | Supports broadband, MPLS, LTE/5G, and satellite. Versa’s AI-driven analytics optimise traffic paths dynamically, utilising real-time link monitoring and application-aware routing. Versa also supports multiple VPNs on a single WAN link. |

| Integrated Security Features | Offers built-in Next-Generation Firewall (NGFW), Secure Web Gateway (SWG) and Zero Trust Network Access (ZTNA). |

| Quality of Service (QoS) | Provides granular QoS policies with dynamic traffic prioritisation and both deep pack inspection and WAN optimisation techniques to help reduce latency. |

| Scalability and Flexibility | Supports enterprise-wide scalability, with easy expansion to new branches and hybrid workforces. Offers zero-touch provisioning (ZTP) and automated deployments. |

| Cloud and Multi-Cloud Integration | Provides direct cloud on-ramps to AWS, Azure and Google Cloud; Versa’s private backbone improves cloud performance. |

| Resilience and Failover Capabilities | Sub-second failover with multi-path redundancy and real-time link health monitoring. |

| Cost Efficiency | Reduces reliance on MPLS by leveraging broadband and LTE/5G. Integrated security eliminates the need for separate firewalls/other security systems, lowering costs. |

| Analytics and Reporting | AI-driven analytics provide historical insights, real-time monitoring and application-level visibility to optimise network performance. |

| Programmatic APIs | Versa offers APIs and SDKs, enabling automation and integration with third-party platforms for custom workflows. |

| Support for Cellular Connectivity | Supports LTE and 5G for primary or backup connectivity. |

| AI Integrations | Uses AI for predictive analytics, automated policy adjustments and self-healing capabilities. |

| Deployment Models Supported | Supports on-premises, hybrid, and fully cloud-based SD-WAN deployments. |

| Compliance and Regulatory Certifications | Certified for ISO 27001, SOC 2, PCI DSS, and HIPAA. |

| Support and Training Options | Offers 24/7 support, dedicated account managers and online training. |

| Target-Market Customers | Targets Finance, Healthcare, Retail, Manufacturing, Education, Government, Technology, Transportation, Energy and Telecommunications. |

Hewlett Packard Enterprise (HPE)

Leader North America Latin America Europe Middle East & Africa Asia-Pacific SMBs

Hewlett Packard Enterprise (HPE) have formed the HPE Aruba EdgeConnect SD-WAN solution from their prior networking expertise and multiple acquisitions of other SD-WAN vendors.

HPE have been long term experts in Software Defined Networking (SDN) solutions. Before offering SD-WAN, HPE offered SDN products with OpenFlow-enabled switches and HP Cloud Managed Network Wireless LAN for small and mid-sized businesses. These lay the foundations for a software-based networking approach, which was later realised in March 2015 when they acquired Aruba Networks.

Improving upon this, in 2020 HPE acquired Silver Peak Systems, who were well-known for their EdgeConnect SD-WAN solution, enabling HPE to integrate EdgeConnect into their Aruba Edge Service platform and now their SD-WAN offers WAN edge infrastructure, as well as advanced routing capabilities.

HPE Aruba's SD-WAN solution now consists of three main components:

EdgeConnect: Available as physical or virtual appliances, supporting hybrid WAN architecture

Aruba Orchestrator: Central administration console for network management

Aruba Boost: Optional WAN optimisation performance pack

| Feature | Vendor/Provider Support |

|---|---|

| Centralised Cloud Management | HPE’s Aruba EdgeConnect SD-WAN provides centralised cloud-based orchestration through Aruba Orchestrator. |

| Support for Multiple Connection Types | Supports broadband, MPLS, LTE, and satellite connections. Uses intelligent path control and first-packet iQ for application-aware routing. |

| Integrated Security Features | Includes built-in NGFW, IDS/IPS and cloud-based security integrations via Aruba ESP and SASE partnerships. Zero Trust capabilities ensure end-to-end security. Whilst support for multiple VPNs on a single WAN connection enable improved segmentation and security. |

| Quality of Service (QoS) | Offers QoS with dynamic traffic prioritisation and automated bandwidth allocation. Improves application performance through first-packet iQ, WAN optimisation, TCP acceleration and deep packet inspection (DPI) techniques. |

| Scalability and Flexibility | Scales for enterprises of all sizes with Zero Touch Provisioning and automated deployments, multi-cloud integration and support for hybrid workforces. |

| Cloud and Multi-Cloud Integration | Provides direct cloud connections to AWS, Azure and Google Cloud, with optimised cloud access and private backbone options. |

| Resilience and Failover Capabilities | Offers sub-second failover, multi-path redundancy and link health monitoring to prevent downtime. |

| Cost Efficiency | Reduces costs by leveraging broadband connectivity, consolidating network functions and offering flexible licensing models. |

| Analytics and Reporting | Provides AI-driven insights, real-time monitoring and application-level visibility through Aruba Orchestrator. |

| Programmatic APIs | Offers RESTful APIs for automation and integration with third-party IT systems. |

| Support for Cellular Connectivity | Supports LTE and 5G connectivity for backup and remote deployments. |

| AI Integrations | Uses AI-powered analytics for predictive performance management, automated policy adjustments and self-healing network capabilities. |

| Deployment Models Supported | Supports on-premises, hybrid and fully cloud-based SD-WAN. |

| Compliance and Regulatory Certifications | Complies with ISO 27001, SOC 2, PCI DSS, and HIPAA standards. |

| Support and Training Options | Provides 24/7 global support, online training and dedicated account managers. |

| Target-Market Customers | Focuses on Finance, Healthcare, Retail, Manufacturing, Education, Government, Technology, Transportation, Energy and Telecommunications. |

Huawei

Challenger Latin America Europe Middle East & Africa Asia-Pacific Large Enterprises

A Chinese vendor, since 2012 Huawei have become the largest telecommunications equipment manufacturer globally, typically known for technology services such as their breakthrough C&C08 telephone switch, which was the most powerful switch in China upon released in 1993.

Huawei previously offered an SDN-based agile controller, launched in 2017 that would later become their SD-WAN solution. In 2018, Huawei progressed via the launch of their SD-WAN cloud services and as of more recent, Huawei have been recognised by Gartner Peer Insights Customers' Choice for SD-WAN for four consecutive times.

Huawei's cloud services include cloud gateways such as Azure, Alibaba Cloud, Huawei Cloud, AWS (Amazon Web Services), the Google Cloud Platform and e-Cloud, which can be essential for businesses utilising a large range of Software-as-a-Service (SaaS) applications or WAN edge infrastructures.

To further create a secure SD-WAN offering, Huawei has integrated SASE capabilities into their SD-WAN through their Xinghe Intelligent SASE Solution, complying with MEF SASE model standards to reduce integration and management complexity for network administrators.

| Feature | Vendor/Provider Support |

|---|---|

| Centralised Cloud Management | Huawei's SD-WAN solution utilises the iMaster NCE platform, offering unified control and real-time visibility across the network. |

| Support for Multiple Connection Types | Huawei supports various transport types, including broadband, LTE, MPLS and satellite connections. |

| Integrated Security Features | Integrates security features such as Next-Generation Firewall (NGFW) and supports end-to-end IPsec encryption. |

| Quality of Service (QoS) | Huawei offers advanced QoS settings, including hierarchical QoS (HQoS) and application-based intelligent traffic steering, ensuring optimal performance for key applications. |

| Scalability and Flexibility | Supports large-scale deployments with flexible networking options. Implements zero-touch provisioning (ZTP) and automated deployments. |

| Cloud and Multi-Cloud Integration | Huawei integrates with leading cloud platforms, providing direct cloud on-ramps and specialised routing algorithms. |

| Resilience and Failover Capabilities | Huawei's SD-WAN offers failover mechanisms such as multi-path redundancy and link health monitoring. |

| Cost Efficiency | By leveraging cost-effective broadband and consolidating network functions, Huawei's SD-WAN solution reduces reliance on expensive MPLS circuits and lowers operational expenses. |

| Analytics and Reporting | Provides detailed analytics and reporting capabilities, offering AI-driven insights and application-level visibility. |

| Programmatic APIs | Huawei offers open APIs within its SD-WAN solution, enabling automation and simplifying integration with existing systems/infrastructure. |

| Support for Cellular Connectivity | Huawei supports both LTE and 5G connectivity. |

| AI Integrations | Huawei utilises AI for predictive analytics and automated policy adjustments. |

| Deployment Models Supported | Huawei's SD-WAN offers on-premises, hybrid and fully cloud-based deployment options. |

| Compliance and Regulatory Certifications | Huawei's SD-WAN complies with the MEF (Metro Ethernet Forum) standard, CSA STAR gold certification, NIST cybersecurity framework and ISO 27018. |

| Support and Training Options | Huawei provides customer support including both 24/7 helpdesks and online training resources. |

| Target-Market Customers | Huawei's SD-WAN solution is suited for various industries including finance, healthcare, retail, manufacturing, education, government, technology, transportation, energy and telecommunications. |

Juniper Networks

Visionary North America Latin America Europe Middle East & Africa Asia-Pacific AI Capabilities

Juniper Networks SD-WAN’s unique selling point is primarily in its vast amounts of Artificial Intelligence (AI) integrations. These include:

Mist AI for insights and automated troubleshooting

Marvis, an AI-driven virtual network assistant for deep insights into client and network behaviours

Automated network security and analytics via AI

Whilst several other vendors have integrated AI for features such as analytics insights and reporting, in our opinion, Juniper Networks has by far the most AI integrations into its services, making it a top SD-WAN provider for AI integrations. One benefit of this use of AI is the reduced complexity for network administrators, who benefit from WAN optimization, advanced routing, Zero Touch Provisioning and secure SD-WAN, all whilst reducing network costs through lower operational workloads.

Following the October 2020 acquisition of 128 Technology, Juniper Networks has further strengthened their market position by adding session-aware networking capabilities to their AI-driven portfolio of features.

| Feature | Vendor/Provider Support |

|---|---|

| Centralised Cloud Management | Juniper’s Mist AI-driven cloud management provides real-time visibility, automation and unified control via the Mist UI. |

| Support for Multiple Connection Types | Supports MPLS, broadband, LTE and satellite with AI-driven analytics and Juniper’s Session Smart Routing for handling dynamic traffic routing. |

| Integrated Security Features | Built-in Next-Generation Firewall (NGFW), Zero Trust Security and Threat Intelligence via Juniper’s Security Director Cloud, supporting multiple VPNs on a single WAN connection for improved segmentation and security. |

| Quality of Service (QoS) | AI-driven dynamic QoS, alongside deep packet inspection (DPI) and policy-based routing (PBR), prioritises important applications, automatically adjusting bandwidth allocation based on network conditions. |

| Scalability and Flexibility | Scales for large enterprises with AI-driven automation, supporting distributed branches and hybrid workforces. Also features zero-touch provisioning (ZTP) with AI-driven automation for branch scaling. |

| Cloud and Multi-Cloud Integration | Direct integrations with AWS, Azure and Google Cloud, with cloud on-ramps and private backbone options for optimised multi-cloud access. |

| Resilience and Failover Capabilities | Offers sub-second failover and multi-path redundancy, with AI-driven link health monitoring. |

| Cost Efficiency | Reduces MPLS dependency by leveraging broadband, with AI-driven optimisation lowering operational expenses. |

| Analytics and Reporting | Offers AI-driven insights, historical trend analysis and detailed application visibility via Mist AI and Marvis Virtual Network Assistant. |

| Programmatic APIs | Open APIs and SDKs enable seamless integration with third-party platforms. |

| Support for Cellular Connectivity | Supports 5G/LTE for failover, remote site deployments and mobile workforce connectivity. |

| AI Integrations | Mist AI enables predictive analytics, self-healing networks and automated policy adjustments. |

| Deployment Models Supported | Supports on-premises, hybrid, and cloud-based SD-WAN deployments. |

| Compliance and Regulatory Certifications | Juniper offers ISO 27001, SOC 2, PCI DSS and HIPAA certifications. |

| Support and Training Options | Provides 24/7 global support, dedicated account managers, online documentation and AI-driven support assistance via Marvis. |

| Target-Market Customers | Designed for Finance, Healthcare, Retail, Manufacturing, Education, Government, Technology, Transportation, Energy and Telecommunications. |

Ericsson (Cradlepoint)

Niche Player North America Latin America Europe Asia-Pacific Remote Workforces

Having acquired Cradlepoint in 2020, Ericsson’s SD-WAN solution has a heavy focus on the cellular wireless and 5G enterprise markets, which has followed into their SD-WAN design. By integrating Cradlepoint's prior SD-WAN solution into Ericsson’s NetCloud Exchange architecture, the solution is ideal for distributed sites, vehicles, Internet of Things (IoT) and remote work environments. This is primarily due to the specialisations in 5G-optimisations for cellular-specific traffic, which can be essential for network resilience.

Having acquired Ericom, a cloud-based security company, improvements have been seen on Cradlepoint's NetCloud platform, which now utilises Ericom's zero trust and cloud-based security solutions to form the basis of the new Cradlepoint NetCloud Threat Defence cloud service to create secure SD-WAN edges. This was an essential step for Ericsson to better deliver edge computing architectures and enable the use of IoT.

| Feature | Vendor/Provider Support |

|---|---|

| Centralised Cloud Management | Offers a cloud-native SD-WAN platform with real-time visibility, centralised policy control and AI-driven analytics. |

| Support for Multiple Connection Types | Supports broadband, LTE, MPLS and satellite, with AI-driven traffic optimisation and real-time traffic analysis for route switching. |

| Integrated Security Features | Features built-in Next-Generation Firewall (NGFW), Zero Trust Network Access (ZTNA) and threat intelligence integrations to improve security, alongside support for multiple VPNs per WAN connection for improved segmentation capabilities. |

| Quality of Service (QoS) | Offers QoS settings with dynamic traffic prioritisation, WAN optimisation, deep packet inspection and AI-driven application policies, particularly for cloud-based and latency-sensitive applications. |

| Scalability and Flexibility | Designed for large enterprises and service providers. Supports zero-touch provisioning, existing legacy network infrastructure and third-party security platforms. |

| Cloud and Multi-Cloud Integration | Direct cloud on-ramps and private backbone connectivity for AWS, Azure and Google Cloud. |

| Resilience and Failover Capabilities | Provides sub-second failover, multi-path redundancy and real-time link monitoring to maintain high availability. |

| Cost Efficiency | Reduces costs by leveraging broadband, consolidating network functions and offering flexible licensing models. |

| Analytics and Reporting | AI-driven analytics provide deep insights into network performance, bandwidth usage and enable predictive maintenance. |

| Programmatic APIs | Offers open APIs and SDKs for automation, enabling integrations with third-party network management tools. |

| Support for Cellular Connectivity | Supports LTE/5G for backup connectivity and remote site connectivity. |

| AI Integrations | Uses AI for predictive analytics, self-healing network capabilities and automated policy adjustments. |

| Deployment Models Supported | Available as on-premises, hybrid and cloud-native. |

| Compliance and Regulatory Certifications | Holds certifications including ISO 27001, SOC 2 and PCI DSS. |

| Support and Training Options | Provides 24/7 support, dedicated account management and online training. |

| Target-Market Customers | Focuses on Telecommunications, Finance, Healthcare, Retail, Manufacturing, Government, Transportation, Energy, Technology and Education. |

Peplink

Niche Player North America Europe Asia-Pacific SMBs

Peplink SD-WAN primarily focuses on wireless and mobile SD-WAN solutions, which compliments their global coverage for their eSIM data plans. Typically targeting Small to medium enterprises (with 1-150 recommended users per deployment), Peplink SD-WAN is ideal for use cases such as IoT, public safety, transport and broadcasting.